Business plan private banker - private banking business thirdthursday.co.za | LV Blog

When applying for a small- business bank loan, it's important to know what your business plan needs to contain to give you an edge. What Bankers Look For in a Plan.

Go to your local or state licensing division and inquire from them what are the necessary permits and licenses you will need to secure in the operation of your private banking business.

This kind of business needs a huge amount of start-up capital. When you start small you can eventually expand once your business starts to pick up.

How do you Ensure your Success in the Business?

Santander: What a Bank is Really Looking for in a Business PlanYou need to establish a more personalized and a close relationship with your client. You can advice them with their financial dealings.

How do i make a business plan for a private banking position?

You can offer to study the business venture they are getting into. Discretion regarding your clients account is the most important of all. Expertise in all the aspects of private banking is also a must.

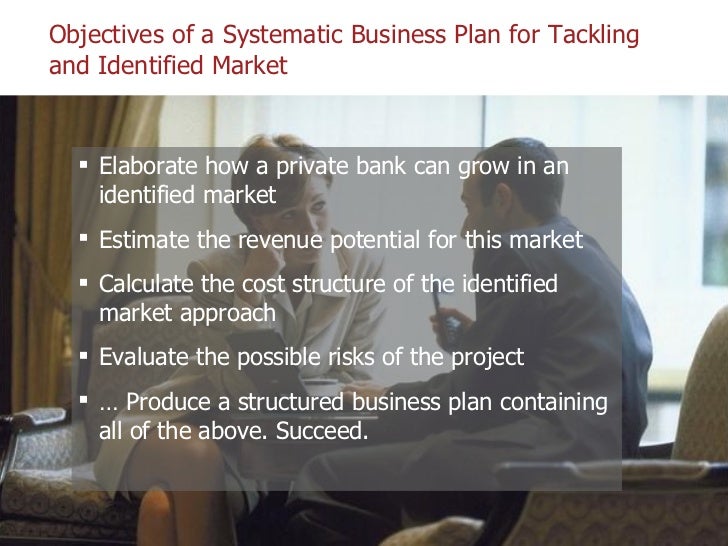

Your mission in this industry must be excellence and integrity in the private banking industry. Before plunging into the business, scout the area where you plan to put up your private banking business.

Take a product partner to lunch. Get to know your Cash Management rep better. See if he knows anybody on your prospect list.

Pick your Wealth Management contact's brain about what she's seeing in the market. Do some industry research.

Investment Banking Services

Not the First Research or RMA kind-everybody does that. Visit some trade association websites to see whether you can learn some things that will make you more knowledgeable about the issues facing your customers and prospects.

Attend a trade association meeting. Meet some friendly accountants.

Review all the financial statements you have received this year and see whether you know all the CPAs who prepared them. If you don't, ask your customers to set up a lunch so you can meet them.

Write an article for a local business publication on a topic that would be of interest to your prospects. Milk it for all it's worth. Before mailing it to the editor, send it to your customers and prospects for comments.

After it's published, get a PDF of the file and share it with everybody you know who might be interested. Review your relationship plans with your Sales Manager. What, no relationship plans?

Keep improving your professional skills. Be honest with yourself about what you need to work on.

If you're a credit wiz who struggles with selling, sign up for a webinar or buy a book on prospecting. If your product knowledge is sub-par, get some tutoring from one of your colleagues.