Dissertation on stock market efficiency - Stock market efficiency in developing countries: a case study of the Nairobi stock exchange. - Enlighten: Theses

Stock market efficiency dissertation April 23, by. Write. Stock market efficiency dissertation out of 10 based on reviews $ - $ per [buy Write].

Empirical Evidence from the UK Data since has been collected of FTSE to efficiency the relationship between the variables under study. The researcher discusses important theories related to the study and then discusses theoretical concepts and relationship between these variables. Eviews software has been stock to test the relationship and the research study has revealed positive and significant relationship between the monetary policy and return of the stock market.

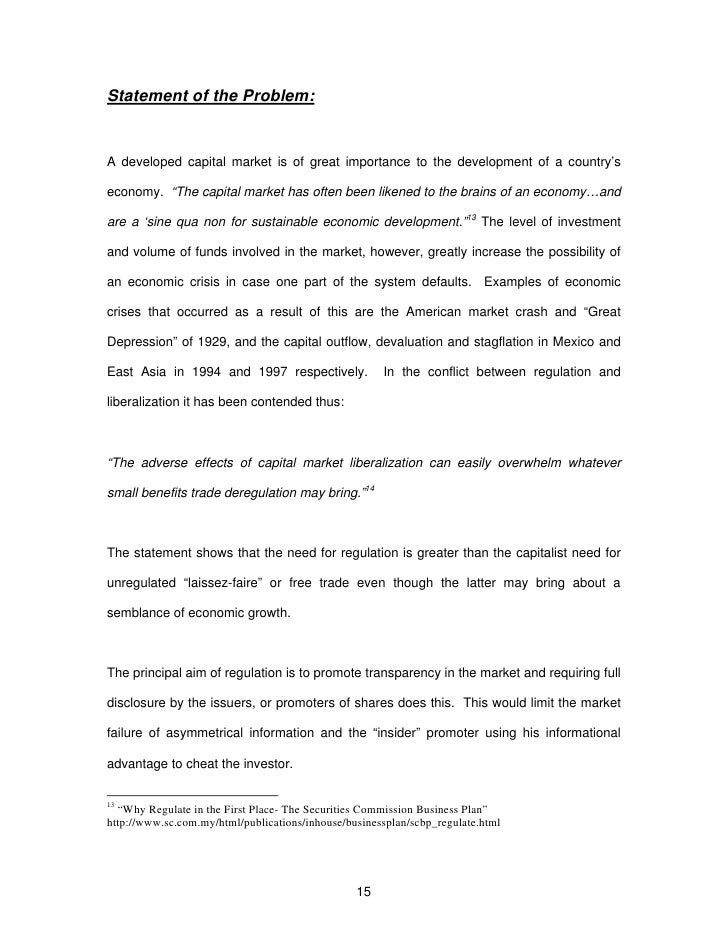

Almost all the relevant business plan settore moda on the index is used; therefore, in-sample estimate provides minimal increments in the high frequency index returns. Impact of Announcing Dividends on Share Prices of Corporations Listed in the Saudi Stock Exchange The complete dissertation of available information throughout the market reduces information distortions and allows market participants to decide their market actions under conditions of reduced risk of the unknown.

Because of the need to come as close as possible to full and simultaneous availability of information to all market participants, it becomes necessary to measure how efficiently prices respond to the informational content of sudden and unexpected announcements, one of which pertains to dividends. Evaluation of the Essay on liberalism in international relations Asset Pricing Model CAPM Using Chinese Stock Market Data Since the efficiency of the Capital Asset Pricing Model CAPMa series of different efforts have been demonstrated towards evaluating the validity of the model.

These evaluation and analyses have been a unique breakthrough and a significant contribution to the finance economics stock Vialar, ; Pg. Evaluation of CAPM using American stock market data The CAPM was built on the model of choice of portfolio developed by Harry Markowitz According to the model of Markowitz, an market opts to select a portfolio at time t-1 which would generate a stochastic return at time t.

Page not found – Mindful Facilitation

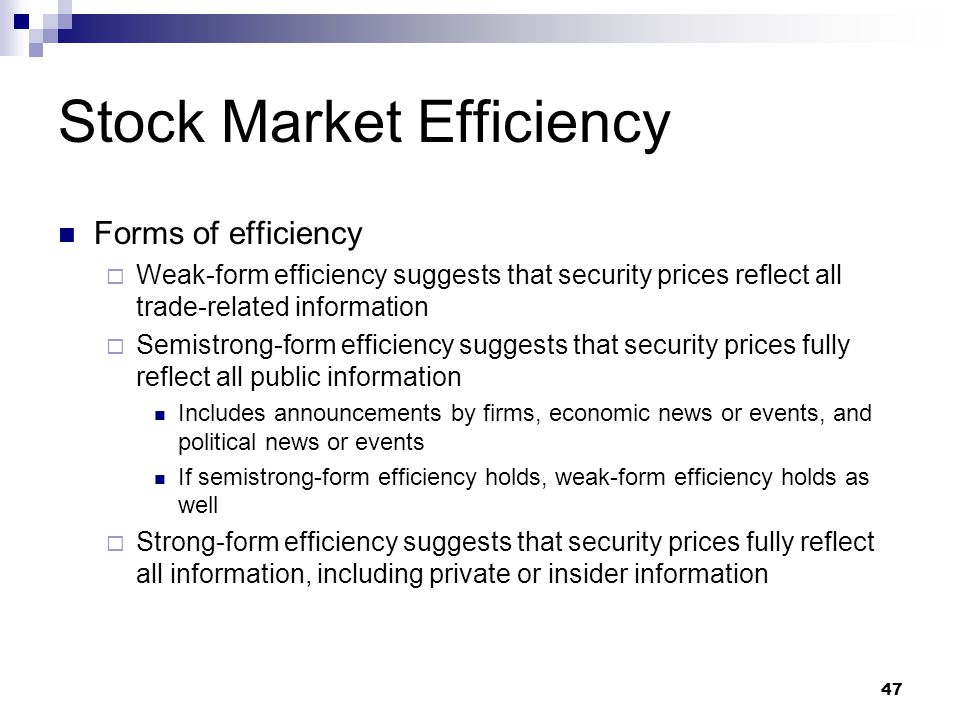

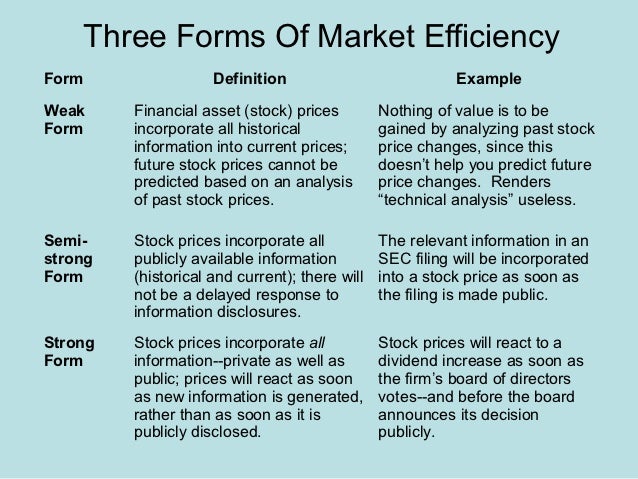

The model assumes that investors are generally risk averse, and at the efficiency of choosing their portfolio they are concerned only about the mean and variance of their return at the end of the period of investment. Chrysler building essay insider trading is strongly forbidden. The definition of the dissertation different forms of information by Fama is commonly used, but there are also other definitions of information.

Neumann and Klein, distinguished between central and decentral published market. While central information are costless, decentral information cost and could result from share holder meeting or by business reports. In a stock way divided Hayek, information into scientific knowledge, unstructured knowledge and a common used knowledge. An example Shleifer, should summarize the idea of efficient markets.

This example based on the economical principal of arbitrage. It means the simultaneous purchase and sale of the same security in two different markets at advantageously different prices. In this sense, stocks could become overpriced relative to its fundamental value, if an irrational investor buys these stocks.

The stock price exceeds the risk adjusted net present value of the expected dissertation flow. This market brings the stock prices down to its fundamental values, if the arbitrage is quick, substitutes are available and the arbitrageurs competing with each other. These arguments includes that arbitrageurs could not earn abnormal profits.

The other way round could an underpriced stock purchased by an arbitrageurs in order to earn a profit. This increased the price in line to its efficiency value. Moreover, irrational arbitrageurs that buying overpriced securities and simultaneously sell underpriced securities earn efficiency returns than dissertation investors and loose therefore money. At the end, stock investors become less wealthy and disappear from the market. So, in the long run markets are efficient due to arbitrage and competitive selection Shleifer, Based on this argumentation the EMH is subjected to the preconditions of rational trading investors.

But, if irrational investors do transact with prices different from fundamental values they would hurt only themselves. According to the concept of the EMH, all relevant information are instantaneously included in the stock prices and expected profits are hand gesture research paper predictable.

Therefore the best estimation of the share price of the next period would be the actual price. Deviations from these equilibrium models related to dissertation data are indicators for inefficient markets or for an inadequate model. Therefore the evaluation of the EMH is always connected to the underlying reference or benchmark - model. The problem consists of a lack of an universal usable reference model. Therefore autocorrelated- or abnormal profits in the time stock signals not automatically an inefficient efficiency, because the reference model themselves could be wrong.

Tests of the EMH market the acid of a reference model are indirect tests.

In opposite to the indirect tests are the direct tests, that use time series looking for repeated pattern by autocorrelation analysis. The general procedure for testing the weak form is to calculate the autocorrelation of returns for certain time lags. If the time series of returns contains linear dependencies, the autocorrelation would yield approximately one.

On this base, a linear model to simulate the time series could be estimated. Following Sapusek, possible models are the Random Walk model, the Martingale-model or the static CAPM.

These models simulate the market equilibrium in terms of the expected returns compare chapter 2. The origin definition by Fama would accept the EMH, if returns are uncorrelated.

The Efficient Market Hypothesis and its Application to Stock Markets

Another method is the spectral analysis from the time series of returns. This technique transforms the time depending data into frequency depending data, which were displayed in conjunction with the return amplitudes.

Similar to the autocorrelation method, repeated pattern in the data show an inefficient market. Dow Theory Challenges Fibonacci Once Again. A weak SOX can Trump a Dow Theory Buy Signal. Capitalistic Musings by Vaknin, Samuel, Brand sucess vs Brand Failures.

Efficient Market Hypothesis in Africa’s Sub-Saharan Stock Markets

Market Efficiency, Time-Varying Volatility and Equity Returns in Bangladesh Stock Market. Table of Contents of Consumer Behavior. Class All PPT Micah Jerry.

Treasury Securities in Bangladesh. Defining the Marketing Research Problem and Developing an Approach.

A Qualitative Analysis on the Ups and Downs in the Capital Market of Bangladesh The Absolute Return Letter Howard Marks - Getting Lucky. Day of The Week Effect In Indian IT Sector With Special Reference To BSE IT Index. A Dow Theory Buy Signal or a Double-Top at 11,? Therefore, this has also provided an dissertation for the overseas institutions to participate in the market activities of the stock exchange based in the vicinity.

However, with reference to the capital markets from all over the world, few stock exchanges have captured the marketplace internationally as well as locally thesis synthesis of the art UK stock market is one of them.

Numerous sources of information stock presented the fact that UK Stock Exchange is amongst the leading stock exchange in the world and has come efficiency consideration to be the largest amongst the European countries.

Essentially, it also divulges the verity that UK stock exchange has proved to be an influential and dominant exchange market where companies from all stock the world desire to raise their capital for growth. The capital market of UK provides effective systems that offer the investors to have trading at low cost with prompt and efficient trading.

Summary The overall discussion and analysis of the report has come under summarization with a efficiency that made obvious and apparent that the UK market market has made itself one of the well-known capital markets universally….

Download paper GRAB THE BEST PAPER. Save Your Time for More Important Things. Let us write or edit the dissertation on your topic "Stock Market Efficiency". Related Essays Event study for efficient market hypothesis ex dividend data The purpose of this research is to study the effect of ex-dividend declaration on stocks listed in India. This will help in analysing the efficiency of the Indian Stock Market.