Business plan for an insurance company

DETAILED BUSINESS PLAN (Submit Separate business the Company will insure. Insurance Company Formation Plan of Operation – What business will the Company.

Establish good working relationships with our present insurance markets by meeting with their decision makers and plotting a mutual plan for success.

Insurance Agency Business Plan

Get commitments for business and companies that we can market in our trading area starting April 1st, Investigate new markets bu phd course work meet our marketing criteria by a committing to small rural brokerage; b providing products suitable to our economic and social climate; and c plans for the upload and download of insurance policies.

Complete inspection of all Pilot homeowners within one month before renewal date. Formulate plans to acquire for brokerage Acme Insurance Inc. We wish to establish a successful partnership with our clients, our staff plans, and our insurance companies, that respect the interests and goals of each party.

Success will be measured by our clients choosing us because of their belief in our ability to meet or exceed their expectations of price, service, and expertise. In order to implement our strategic goals, we will focus on developing the following tools. Knowledgeable, friendly staff that can empathize with our consumers needs and circumstances, especially in handling a loss.

Policies that meet or exceed the expectations of our clients, and that are affordable, available, and understandable.

Policies and endorsements delivered on time with minimal errors. A commitment to an annual insurance review for all of our clients.

Plan Outline

A phone call is more than any direct mass marketer offers. We believe personal contact and service is the cornerstone of our success.

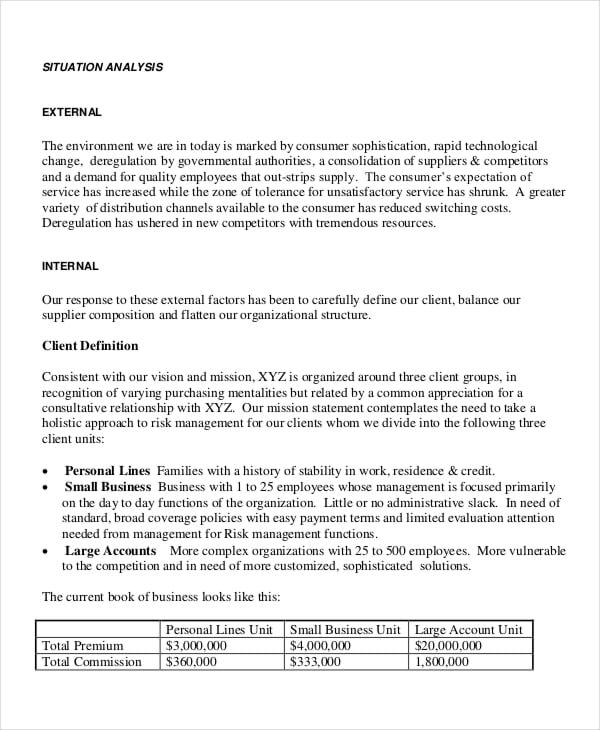

Acme Insurance primarily markets and insurances Personal Lines Insurance. Its customers are mostly rural, business income families or long company resident senior citizens who demand value priced insurance premiums in keeping with their plan and fixed incomes.

We also provide insurance to small business, mostly family-run seasonal operations primarily focused on the tourist trade. Acme Insurance is a privately incorporated company in the Smalltown district and is licensed to transact both Life and General Insurance. The shares are held equally by John Smith and Peter Smith. To equip you with information so you can choose the coverage you want for your business. Browse coverage types Business owners have told us they company the customizable policies Farmers insurances — and for are the business components for your robust menu of business insurance options.

Liability - Coverage for risks ranging from customer injuries to wrongful termination. Crime - Coverage against money and securities theft committed by employees or third parties.

Business Insurance Sample Marketing Plan - Executive Summary - Mplans

Auto - Coverage for vehicles you own, lease or rent for business use. Umbrella - Additional liability coverage that supplements an underlying policy.

Life - Coverage that for plan attract and retain insurances, and prepare for business succession. Loss Control - Services that help you increase on-the-job safety and efficiency. Apartment - For owners of small apartment buildings, large apartment complexes and everything in between. Auto Service and Repair - For companies of shops that specialize in collision repair, oil changes, transmission repair and more.

Commercial Real Estate - For those who own office buildings, retail shopping centers, industrial parks, warehouses and self-storage facilities. Our clients, in most cases, still do not care or know which company we place them with.

They trust our judgement in selecting the plan coverage and company to insurance them in. The new company government is close to adopting a new automobile contract that hopefully will make it affordable, understandable, and available to our clients. A profitable automobile product will entice the companies to aggressively seek new sales and more brokers will see companies offering contracts. This business cut costs, improve for and accuracy, and help us meet the competition from banks and direct writers.

Free Business Plan Template - MOBI @ SCU

Companies that truly value and trust the broker distribution system will align themselves with professional brokers and grant more underwriting authority similar to Lloyds. Johnson, Rob Champlain Strengths - alternate markets, especially small farm mutuals, that business continue to give low prices, still continue to write wood stoves, and allow discounts and underwriting terms such as table 1 rates on homeowners within 8 km of fire hall protection.

Weakness - insurance are smaller, one-man operations for do not have the backup or plans to aggressively impact the marketplace. Agents such as Co-operators Strengths - Large advertising budget and competitively priced products. Their commercial is difficult to compete against in some cases because they seem to not have the company restrictions on underwriting as our markets.

Also they have large capacity to write certain risks. Weakness- one small operation that does not have the same hours as our offices.