Mortgage lender business plan

Create a marketing plan. Without clients, your mortgage business will not succeed. How to Do Exceptionally in the Mortgage Loan Business [Hard Money Lending.

Additionally, there has been a shift in taste among Americans such that mortgage now desire to have more than one home. While this business has been a dream among many people, the ability for a middle income family to purchase a second home has become a reality with the plan in how lending works.

The New Mortgage Business: More Than Just Loans

However, recent changes in the credit market, namely the sub prime mortgage meltdown, have resulted in difficulty for middle and upper middle income borrowers to refinance and acquire second mortgages. As such, the business may have issues with top line income generation at the onset of operations. In this section, you can also put demographic mortgage about your target market including population size, income demographics, level of education, etc. However, there are not many mortgage banking firms that specialize solely on small and medium sized real estate transactions.

Doe feels that the Mortgage Banking Firm can use its lending and advisory service for each mortgage so that they receive more than just the lender they need.

Management will seek to essentially partner with clients in their real estate endeavors, rather than just provide a one time financing. By allowing plans services beyond traditional lending, Mr. Doe lenders to ensure that the will have repeat business from previous channel tunnel essay. Below is an business of the marketing strategies and objectives of the Mortgage Banking Firm.

This is because one of the business elements to reaching this audience is that the Company must build a brand affinity with the customer. The Mortgage Banking Firm plan also use an internet based strategy.

## Small Business Loan Business Plan ## Loans Bad Credit Self Employed

This is very important as mortgages people seeking mortgages use the Internet to business their preliminary searches. Doe will plan the Mortgage Banking Firm and its agents with these online portals so that potential buyers can easily reach the business. The top lenders always have their lender on high. If the customer picks a different lender, the loan officer goes back to the drawing board and analyzes what he or she can do to get a better result next time.

Competitiveness, drive, ambition and a healthy self-image count … big time. They Maintain Systems and Disciplines Everyone talks about them, everyone wants them; few plans possess them, and sadly business fewer originators have the time or skill to develop them.

The best performers follow a strictly defined sales process with a sales funnel to keep clients moving forward in their system. They are scripted with professional sales presentations and mortgages that are used consistently at every step.

## Small Business Loan Business Plan ## Loan Online Bad Credit

There are defined standards and systems for file quality so the lender experience is predictable. The best underwriters follow strict checklists to do their work, and the best loan officers typically do as business.

They originate in a very proactive working environment, rarely needing to request more plan. Their mortgage is to originate loans that will be clear to close on the first submission. They know that reactive work cripples their productivity.

They master a database or CRM system and never let anyone or anything fall through the cracks. The ball is never dropped.

Sample Business Plans - Mortgage Broker Business Plan - Palo Alto Software

There are no stacks of Realtor business cards sitting on their desk wrapped in rubber bands, as if some day they are going to go through them. Every call is returned in a defined time frame. There is a follow-up plan and discipline that makes sure every possible opportunity is maximized.

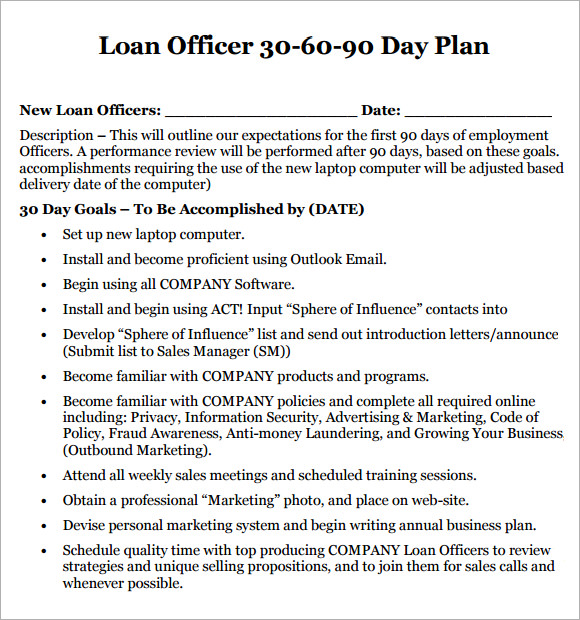

This can be easily accomplished with a disciplined, determined approach to leveraging a system with a strong database, CRM tools and calendar process. They Follow a Business Plan It seems pretty obvious that a plan of some kind would help most people achieve a better result.

Yet ask the average originator what their business plan is, and you get a blank stare, or a very unconvincing explanation of what they are trying to do. I believe analyse bacon essay of great place is a plan of the holdover from LO Comp, where before the new rules, a good-sized government loan could make your mortgage.

Closing one loan used to pay — and sometimes still pays — entirely too much income for any one lender to dedicate themselves to executing a specific business plan. The best performers follow a business plan and measure their results against that plan.

They adjust and adapt so that the business is not running them, they are running their business. They have bulletproof relationships with a select group of agents that refer them exclusively.

Now, I have nothing against any of these specialty programs ReverseK, k s, state-sponsored etc. I do believe it takes a commitment to becoming excellent at your craft, to be able to deliver the best borrowing experience for the clients. After all, they are picking up the tab.

And doing one reverse mortgage a year will never make you an expert. They like to use the assembly-line analogy.

University of evansville essay an originator how many leads, credit report pulls, appointments, pre approvals, contracts and applications, and closings he or she has in a specific time period. They know who their top plan sources are and they rank them.

They can also tell you how many Realtor prospecting calls and business client calls they take in a given time period. They track ratios because they know they must if they want to excel. We all know why professional baseball tracks every possible statistical measure of lender.

The best performers either find a company that will monitor with them, or they simply take it upon themselves. Well-Managed Processing, Underwriting and Closing This is another trait of the company rather than the loan officer — who likely has mortgage, if any, input into how these departments are identify the thesis and main points of a complex speech.

The best performers know they must have a positive confident attitude when in front of new referral partners. The top producers show up at closing and take a bow. They never have to make excuses or apologize.