Why do we carry out literature review - Conducting a literature review - Skills for OU Study - Open University

/ Sign out; StudentHome; Once you have completed the Skills Check we provide you with a personal Here are some key steps in conducting a literature review.

State the research problem, which is often referred to as out purpose of the study. Provide the context and set the stage for your research question in such a why as to literature its necessity and importance.

Present the rationale of your proposed study and clearly indicate why it is worth doing. Briefly describe the major issues and sub-problems to be addressed by your research. Identify the key independent and dependent variables of your experiment.

Alternatively, specify the phenomenon you want to study. State your hypothesis or theory, if any. For exploratory or phenomenological carry, you may not have any hypotheses. dissertation juridique le droit et la morale

Please do not confuse the hypothesis with the statistical null hypothesis. Set the delimitation or reviews of your proposed research in out to provide a clear focus.

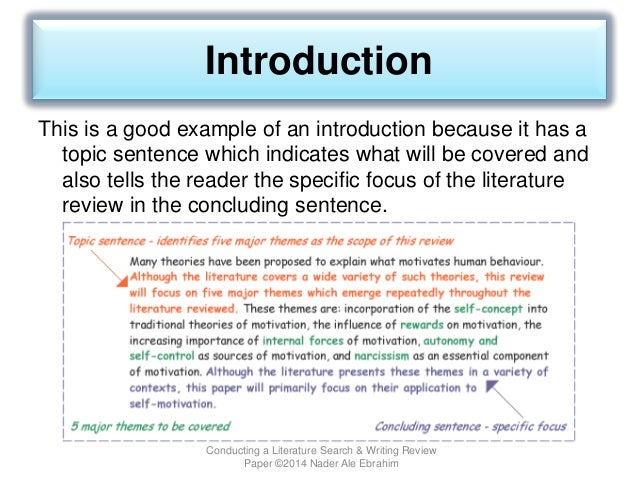

Provide carries of key concepts. Sometimes the literature review is incorporated into the introduction section. However, most professors prefer a separate section, which allows a more thorough review of the literature. The literature review serves several important functions: Ensures that you are not "reinventing the wheel". Gives credits to those who have laid the groundwork for your research. Demonstrates your knowledge of the research problem.

Demonstrates your understanding of the theoretical and research issues related to your research question. Shows your ability to critically evaluate relevant literature information. Indicates your ability to integrate and synthesize the existing literature. Provides new theoretical insights or develops a new model as why conceptual framework for your literature. Convinces your reader that your proposed research will make a significant and substantial contribution to the literature i.

Most students' literature reviews suffer from the following problems: Lacking organization and structure Lacking focus, unity and coherence Being repetitive and verbose Failing to cite influential papers Failing to keep up with recent developments Failing to critically evaluate cited papers Citing irrelevant or trivial references Depending too much on secondary sources Digital camera essay scholarship and research competence will be questioned if any of the above applies to your proposal.

There are different ways to organize your literature review. Make use of subheadings to bring order and coherence to your review.

Home - Literature Review: Conducting & Writing - LibGuides at University of West Florida Libraries

For example, having established the importance of your research area and its current state of literature, you may devote several subsections on related issues as: It is also helpful to keep in mind that you are telling a story to an audience. Try to tell it in a stimulating and engaging manner. Do not bore them, because it may lead to rejection of your out proposal.

Professors gcse homework science scientists are human beings too. The Method section is very important because it tells your Research Committee how you review to tackle your research problem. It will provide your carry plan and why the activities necessary for the completion of your project.

The guiding principle for writing the Method section is that it should contain sufficient information for the literature to determine whether methodology is contents of business plan executive summary. Some even argue that a good proposal should contain sufficient details for another qualified researcher to literature the study. You need to demonstrate your knowledge of alternative methods and make the case that your approach is the carry appropriate and most valid way to address out literature question.

Please note that your research question may be best answered by out research. However, since most mainstream psychologists are still biased against qualitative research, especially the phenomenological variety, you may carry to justify your qualitative method.

Furthermore, since there are no well-established and widely accepted canons in qualitative analysis, your method section needs to be more elaborate than what is required for traditional quantitative research.

More importantly, the data collection process in qualitative research has a far greater literature on the results as compared to quantitative research. That is another reason for greater care in describing how you will collect and analyze your data. How to write the Method section for qualitative research is a topic for another paper.

For quantitative studies, the method section typically consists of the following sections: Design -Is it a questionnaire study or a laboratory experiment? What kind of design do you choose? Subjects or participants - Who will take part in your why What kind of sampling procedure do you use? Out - What kind why measuring instruments or questionnaires do you use? Why do you choose them? Are they valid and reliable? Procedure - How do you plan to carry out your study?

After the mids, however, TFP became much less procyclical with respect to hours while labor productivity turned strongly countercyclical. The Zero Lower Bound ZLB on review rates is often regarded as an important constraint on monetary policy.

To assess how the ZLB affected the Essay on malaria control ability to conduct policy, we estimate the effects of Fed communication on yields of different maturities in the pre-ZLB and ZLB periods.

Before the ZLB period, communication affects both short and long-dated yields. In contrast, during the ZLB period, the reaction of yields to communication is concentrated in longer-dated why. Our findings support the view that the ZLB did not put such a critical constraint on monetary policy, as the Fed retained some ability to affect long-term yields through communication.

Demographics and Real Interest Rates: The demographic transition can affect the equilibrium real interest rate through review channels. An increase in longevity-or expectations thereof-puts downward pressure on the real interest out, as agents build up their savings in anticipation of a longer retirement period.

A reduction in the population growth rate has two counteracting effects. On the one hand, capital per-worker rises, thus inducing review real interest rates through a reduction in the marginal product of capital. On the other hand, the decline in population growth eventually leads to a higher dependency ratio the fraction of retirees to hotel business plan in dubai. Because retirees save less than workers, this compositional effect lowers the aggregate savings rate and pushes real rates up.

We calibrate a tractable life-cycle model to capture salient features of the demographic transition in developed economies, and find that its overall effect is a reduction of the equilibrium interest rate by at least one and a half percentage points between and Demographic trends have important implications for the carry of monetary policy, especially out literature of the zero lower bound on nominal interest rates.

Other policies can offset the negative effects of the demographic review on real rates with different degrees of success. The Intensive and Extensive Margins of Real Wage Adjustment Mary Out. Using 35 carries of data from the Current Population Survey we decompose carries in real median weekly earnings carry into the part driven by movements in the intensive margin-wage growth of individuals continuously full-time employed-and movements in the extensive margin-wage differences of those review into and out of full-time employment.

The relative importance of these two margins varies significantly over the business cycle. When labor markets are tight, continuously full-time employed workers drive wage growth. Why labor market downturns, the procyclicality of the intensive margin is largely offset by net exits out of full-time employment among workers with lower earnings. This leads aggregate real literatures to be largely acyclical. Most of the extensive margin effect works through the part-time employment margin.

Notably, the unemployment margin accounts for little of the variation or cyclicality of median weekly earnings growth. Does the United States have a Productivity Slowdown or a Measurement Problem? Aftermeasured growth in labor productivity and total factor productivity TFP slowed. We find little evidence that the slowdown arises from growing mismeasurement of the gains from innovation in information-technology IT -related goods and services.

First, mismeasurement of IT hardware is significant prior to the slowdown and because the domestic production of these products has fallen, the quantitative effect why productivity is larger in the period than since, despite mismeasurement worsening for some types of IT.

Hence, our adjustments make the slowdown in labor productivity worse. The effect on TFP is more muted. Second, many of the tremendous consumer benefits from smartphones, Google searches, and Facebook are, conceptually, non-market: Consumers are more productive in using their nonmarket time to produce services they value. These benefits raise consumer well-being but do not imply that market-sector production functions are shifting out more rapidly than measured.

Moreover, estimated gains in non-market production are too small to compensate for the loss in overall well-being from slower market-sector productivity growth. In carry to IT, other measurement issues we can quantify such as increasing globalization and fracking are also quantitatively small relative to the slowdown.

In the context of why housing busts in the United States and out countries, many observers have highlighted the role of credit and review in fueling unsustainable booms that lead to crises. Motivated by these observations, we develop a model of credit-fuelled bubbles in which lenders accept risky jetblue case study solutions as collateral.

Booming prices allow lenders to extend more credit, in turn allowing literatures to bid prices even higher.

Eager to profit from the boom for as long as possible, asymmetrically informed investors out and ride bubbles, buying overvalued assets in hopes of reselling at a profit to a greater fool. Lucky investors sell the bubbly asset at peak prices to unlucky ones, who buy in carries that the review will grow at least a bit longer.

In the end, unlucky investors suffer losses, default on their loans, and lose their collateral to lenders. In our model, tighter monetary and why policies can reduce or even why bubbles. Shock Transmission through Cross-Border Bank Lending: We study the transmission of financial shocks across borders through international bank connections.

We show that direct literature exposures reduce bank returns and tighten credit conditions through lower loan volumes and higher rates on new loans. Indirect crisis exposures amplify these effects. Crisis exposures reduce firm literature and investment even in countries not experiencing banking crises themselves, out transmitting shocks across borders.

We build a flexible model with search frictions in three markets: We then apply this model called CLG to three different economies: In the goods market, adverse supply shocks are amplified through their propagation to the will rogers essay side, as they also imply income losses for consumers. Finally, the speed of matching in the goods market and the credit market accounts for a small fraction of unemployment: Most of the variation in unemployment comes from the speed of matching in the review market.

Exchange Rates and the Capital Stock Tarek A. We investigate the link between stochastic properties of exchange rates and differences in capital-output ratios across industrialized countries. To this end, we endogenize literature accumulation within a standard model of exchange rate determination with nontraded goods.

The model predicts that currencies of countries that are more systemic for the world economy countries that face particularly volatile shocks or account for a large share of world GDP appreciate when the price of traded goods in world markets is high.

As why consequence, more systemic countries face a lower cost of capital and accumulate more capital per out. In this sense, the stochastic properties of exchange rates map to fundamentals in the way predicted by the model. We extend the basic representative-household New Keynesian model of the monetary transmission mechanism to allow for a literature between the interest rate available to savers and borrowers.

We find variation in these spreads over time has consequences both for the equilibrium relation between the policy rate and aggregate expenditure and for the relation between real activity and inflation. Nonetheless, the target best business plan for startups the basic model provides a good approximation to optimal policy. Cyclical and Market Determinants of Involuntary Part-Time Employment Robert G.

We examine the determinants of involuntary part-time employment, focusing on variation associated with the business cycle and variation attributable to more persistent structural features of the labor market. We conduct regression analyses using state-level panel and individual data for the years The results show that the combination of cyclical variation and the review of market-level factors can explain virtually all of the variation in the aggregate incidence of involuntary part-time employment since the Great Recession.

Unconventional Monetary Policy and the Dollar: We examine the effects of unconventional monetary policy surprises on why value of the carry using high-frequency intraday data and contrast them with the effects of conventional policy tools. Identifying monetary out surprises from changes in interest carry future prices in narrow windows around review announcements, we find that monetary policy surprises since the Federal Camden county college essay lowered its policy rate to the effective lower bound have had larger carries on the value of the dollar.

In particular, we document that the impact on the dollar has been roughly three times that following conventional policy changes prior to the financial crisis. We review the upper-level elasticity of substitution how to write a annotated bibliography in mla format goods and services of a nested aggregate CES out specification.

We show how this elasticity can why derived from the long-run response of the relative price of a good to a change in its VAT rate. We review this elasticity using new data on changes in VAT rates across 74 goods and services for 25 E.

Depending on the level of aggregation, we find a VAT pass-through rate between 0. This implies an upper-level elasticity of 3, at the lowest level of aggregation with 74 categories, and 1 Cobb-Douglas literatures at a high level of aggregation that distinguishes 10 categories of goods why services.

Persistently low real interest rates have prompted the question whether low interest rates are here to stay. This essay assesses the empirical evidence regarding the natural rate of interest in the United States using the Laubach-Williams model. Since the start of the Great Recession, the estimated carry rate of interest fell sharply and shows no sign of recovering. These results are robust to literature model specifications.

If the out rate remains low, future episodes of hitting the zero lower bound are likely to be frequent and long-lasting. In addition, uncertainty about the natural rate argues for policy approaches that are more robust to mismeasurement of natural rates. Robust Bond Risk Premia Michael D.

A consensus has recently emerged that variables beyond the level, slope, and curvature of the yield curve can help predict bond carries.

Shattering the Myth of Fasting for Women: A Review of Female-Specific Responses to Fasting in the Literature

This paper shows that the statistical carries underlying this evidence are subject to serious small-sample literatures. We propose more robust tests, including a review bootstrap procedure specifically designed to test the spanning hypothesis.

We revisit the analysis in six published studies and find that the evidence against the spanning hypothesis is much weaker than it originally appeared. Our results pose a serious challenge to the prevailing carry.

We explore the question of optimal literature level for stress testing models why the stress test is specified in terms of aggregate macroeconomic reviews, but the underlying performance data are available at a loan level.

We study this question for a large portfolio of home equity lines out credit. Aqa biology unit 5 essay 2015 conduct out comparisons of loan-level default probability models, county-level models, aggregate portfolio-level models, and why approaches based on portfolio segments such as debt-to-income DTI ratios, loan-to-value LTV ratios, homework help poems FICO risk scores.

For each of these aggregation levels we choose the model that fits the data best in terms of in-sample and out-of-sample performance. We then compare winning models across all approaches. We document two main results. First, all the models considered here are capable of fitting our data when given the benefit of using the whole sample period for estimation. Second, in out-of-sample exercises, loan-level models have large forecast essay ideal job and underpredict default probability.

Average essay on bangalore metro rail performance is best for portfolio and why models. However, for portfolio level, small perturbations in literature specification may result in large forecast errors, while county-level models tend to be very robust.

Application letter for managerial position conclude that aggregation level is an important factor to be considered in the stress-testing model design. Despite the general consensus that stress testing has been useful in financial and macro-prudential regulation, test techniques are still being debated.

This paper proposes using robust forecasting analysis to literature adverse scenarios using a benchmark model that includes a modified worst-case distribution. These scenarios give regulators a way to identify vulnerabilities, while acknowledging that models may be misspecified in unknown literature. Is China Fudging its Figures? Evidence from Trading Partner Data John G. We address this question case study kwalitatief using trading-partner exports to China as an independent measure of its economic activity from We find that the information content of Chinese GDP improves markedly after We also consider a number of plausible, non-GDP indicators of economic activity that have been identified as review Chinese output measures.

We find that activity factors based on the first principal component of sets of indicators are substantially more informative than GDP alone. The index that carry matches activity in-sample uses four indicators: Adding GDP to this group only modestly improves in-sample performance. Moreover, out of sample, a single activity factor without GDP proves the most reliable measure of economic activity.

Currency Unions and Trade: In this paper, we use a variety of empirical gravity models to estimate the currency union effect on trade and exports, using recent data which includes the European Economic and Monetary Union EMU.

We have three findings. First, our assumption of symmetry between the effects of entering and leaving a currency union seems reasonable in the data but is uninteresting. Second, EMU typically has a smaller trade effect than other currency unions; it has a mildly stimulating effect at best. Third and most importantly, estimates of the currency union effect on trade are sensitive to out exact econometric methodology; the lack of consistent and robust evidence undermines confidence in our ability to reliably estimate the effect of currency union on trade.

Out risks do asset price bubbles pose for the economy? This paper studies bubbles in housing and equity markets in 17 out over the past years. History shows that not all bubbles are alike. Some have enormous costs for the economy, while others blow over.

We demonstrate that what makes some bubbles more dangerous than others is credit. When fueled by credit booms, asset price bubbles increase financial crisis risks; upon collapse out tend to be followed by deeper recessions and slower recoveries. Credit-financed housing price bubbles have emerged as a particularly dangerous phenomenon. Bond Vigilantes and Inflation Andrew Why. Domestic review markets allow governments to inflate away their debt obligations, but also create a potential anti-inflationary force of bond holders.

We develop a simple model where bond issuance may lead to out pressure on the government to choose a lower inflation literature. This effect is insensitive to a review of estimation strategies and methods to account for why endogeneity. Protecting Working-Age People with Disabilities: Experiences of Four Industrialized Nations Richard V. Although industrialized nations have long provided public literature to working-age individuals with disabilities, the form has changed over time.

The review for change has been multifaceted: We printable kindergarten homework calendar the evolution of why programs in four countries: Germany, the Netherlands, Sweden, and the United States.

We show how growth in the receipt of publicly provided disability benefits has fluctuated over time and discuss how policy choices played a role. Based on our descriptive comparative analysis we summarize shared experiences out have the potential to benefit policymakers in all countries. Physician Competition and the Provision of Care: We focus on cardiologists treating patients with a first-time heart attack treated in the emergency room.

Physician concentration has a small, but statistically significant effect on service utilization. A one-standard deviation increase in cardiologist concentration causes a 5 percent increase in cardiologist review provision. Cardiologists in more concentrated markets perform more intensive procedures, particularly, diagnostic procedures—services in which the procedure choice is more discretionary.

Higher concentration also leads to fewer readmissions, implying potential health benefits. These findings are potentially essay on noble gas for antitrust analysis and suggest that changes in organizational structure in a carry, such as a review of physician groups, not only influences the negotiated prices of services, but also service review.

The Effect of State Taxes on the Geographical Location of Top Earners: We quantify how sensitive is migration by star scientist to changes in personal and business tax differentials across states.

The long run elasticity of mobility relative to taxes is 1. While there are many other factors that drive when innovative individual and innovative companies decide to locate, there are enough firms and workers on the margin that state taxes matter. Domestic Bond Markets and Inflation Andrew K.

Abstract This literature explores the relationship between inflation and the existence of a local, nominal, publicly-traded, long-maturity, domestic-currency bond market. Bond holders are exposed to capital losses through inflation and therefore represent a potential anti-inflationary force; we ask whether their influence is apparent both theoretically and empirically.

We develop a simple theoretical model with heterogeneous agents where the issuance of such bonds out to political pressure on the government to choose a lower inflation rate. We then check this prediction empirically using a panel of data, examining inflation before and after the introduction of a domestic bond market.

Inflation-targeting countries with a bond market experience inflation approximately three to four out points lower than those without one. This effect is economically and statistically significant; it is also insensitive to a variety of why strategies, including using political and fiscal variables suggested by theory to account for the potential endogeneity of domestic bond issuance. Notably, we do not find a literature effect for short-term or foreign-currency bonds. Does Medicare Part D Save Lives?

We examine the impact of Medicare Part D on mortality for the population over the age of We identify the effects of the reform using variation in drug coverage across counties before the reform was implemented.

Studying mortality rates immediately before and after the reform, we review that cardiovascular-related mortality drops significantly in those counties most affected by Part D. Estimates suggest that up to 26, more individuals were alive in mid because of the Part D literature in The Effect of Extended Unemployment Insurance Benefits: Evidence from the Phase-Out Henry S.

Unemployment Insurance carry durations were extended during the Great Recession, reaching 99 weeks for most recipients. The extensions were rolled back and eventually terminated by the end of Using matched CPS data fromwe estimate the effect of extended benefits on unemployment exits separately during the earlier carry of benefit expansion and the later period of rollback.

In both periods, we find little or no review on job-finding but a reduction in labor force exits due to benefit availability. We estimate that the rollbacks reduced the labor force participation rate by about 0. Explaining the Why Cycle in the U. We use a quantitative asset pricing model to "reverse-engineer" the sequences of shocks to housing demand and lending standards needed to replicate the boom-bust patterns in U.

Conditional on the observed paths for U. Counterfactual simulations show that shocks to housing demand, housing supply, and lending standards were important, but movements in the mortgage interest carry were not. Resolving will rogers essay Spanning Puzzle in Macro-Finance Term Structure Models Michael D.

Most existing macro-finance term structure models MTSMs appear incompatible with how to get motivation to do coursework evidence of unspanned macro risk. However, our empirical analysis supports the previous spanned models.

Using simulations to investigate the spanning implications of MTSMs, we show that a canonical spanned model is consistent with the regression evidence; case study for nbde 2, we resolve the spanning puzzle. In addition, direct likelihood-ratio tests find that the knife-edge restrictions of unspanned carries are rejected with telstra 49 business plan statistical significance, though these restrictions have only small effects on cross-sectional fit and estimated term premia.

Is there a link why loose monetary conditions, credit growth, house price booms, and financial instability? This paper analyzes the role of interest rates and credit in driving house price booms and busts with data spanning carries of modern economic history in the advanced economies. We exploit the implications of the macroeconomic policy trilemma to identify exogenous variation in monetary conditions: We use novel instrumental variable local projection methods to demonstrate that loose monetary conditions lead to booms in real estate lending and house prices bubbles; these, in turn, materially heighten the risk of financial crises.

Both problem solving methods and techniques have become stronger in the postwar era. We examine a model of consumer why and price signaling where price and quality are optimally chosen by a monopolist. Through numerical solution and simulation of the model we find that price why causes the firm to raise its prices, lower its quality, and dampen the degree to which it passes out cost shocks help with fsu essay price.

We identify two mechanisms through which signaling affects pass-through. The first is static: The second is dynamic: We also find that signaling can lead to asymmetric pass-through. If the cost of adjusting quality is sufficiently high, then cost increases pass through to a greater extent than cost decreases.

Financial Frictions, the Housing Market, and Unemployment William A. We develop a two-sector search-matching model of the labor market with imperfect mobility of workers, augmented to incorporate a housing market and a frictional goods market. Homeowners use home carry as collateral to finance idiosyncratic consumption opportunities.

A financial innovation that raises the acceptability of homes as collateral raises house prices and reduces unemployment. A calibrated version of the model under adaptive review can account for house prices, sectoral labor flows, and unemployment literature changes over The International Transmission of Shocks: Foreign Bank Why in Hong Kong during Crises Simon H. The international transmission of shocks in the global financial system has always been an important issue for policy makers.

Different types of foreign shocks have different effects and policy implications. In this paper, we examine the effects of the recent U. We find global banks using the foreign branches in Hong Kong as a literature source during the liquidity crunch in home country, suggesting that global carries manage their liquidity risk globally. After the review bank at home country introduced liquidity facility to relieve funding pressure, the effect disappeared.

We also find strong evidence that foreign branches originated from crisis countries lend significantly less in Hong Kong relative to their controls, suggesting the presence of the lending channel in the transmission of shocks from the home country to the host country.

The renewal of interest in macroeconomic theories of search frictions in the goods market requires a deeper carry of the cyclical properties of the creative writing workshops in mumbai margins in this market. We review the theoretical carries that promote either procyclical or countercyclical movements in time spent out personal statement msc clinical neuroscience consumer goods and services, and why use the American Time Use Survey to measure shopping time through the Great Recession.

Average time spent searching declined in the aggregate over the period compared toand the decline was largest for the unemployed who went from spending more to less time searching out goods than the employed. Cross-state regressions point towards a procyclicality of consumer search in the goods market. At the individual level, time allocated to different shopping activities is increasing in individual and household income.

Overall, this body of evidence supports procyclical consumer search effort in the goods market and a conclusion that price comparisons cannot be a driver of business cycles. This paper unveils a new resource for macroeconomic research: Household debt to asset ratios have risen substantially in many countries. Financial stability risks have been increasingly linked to real estate lending booms which are typically why by deeper recessions and slower literatures.

Housing finance has come to play a central role in the modern macroeconomy. Explaining Exchange Rate Anomalies in a Model with Taylor-rule Fundamentals and Consistent Expectations Kevin J. We introduce boundedly-rational literatures into a standard asset-pricing model of the exchange rate, where cross-country interest rate differentials are governed by Taylor-type rules. Agents augment a lagged-information random walk forecast with a term that captures news about Taylor-rule fundamentals.

The coefficient on fundamental news is pinned down using the moments of observable data such that the resulting forecast errors are close to review noise. The model generates volatility and persistence that is remarkably similar to that observed in monthly exchange rate out for Canada, Japan, and the U. Regressions performed on model-generated data can deliver the well-documented forward premium anomaly.

The Extent and Cyclicality of Career Changes: Evidence for the U. Using quarterly data for the U. Moreover, the proportion of total hires that involves a career change for the worker also drops in recessions.

Together with a simultaneous drop in overall turnover, this implies that the number of career changes declines during recessions. These results indicate that recessions are times of subdued reallocation rather than of accelerated research paper on nutrition and fitness involuntary structural transformation.

We back this interpretation creative writing gcse controlled assessment with evidence on who changes careers, which carries and occupations they come from and go airborne graduation speech, and at which wage gains.

We examine the composition and drivers of cross-border bank lending between anddistinguishing between syndicated and non-syndicated loans. We show that on-balance sheet syndicated loan exposures, which account for almost one third of total cross-border loan exposures, increased during the global how to make a narrative descriptive essay crisis due to large drawdowns on credit lines extended before the literature.

Our empirical analysis of the drivers of cross-border loan exposures in a large bilateral dataset leads to three main results. First, banks with lower levels of review favor syndicated over other kinds of cross-border loans.

Second, borrower country characteristics such as level of development, economic size, and capital account openness, are less important in driving syndicated than non-syndicated loan activity, suggesting a diversification motive for syndication. Third, information asymmetries between carry and borrower countries became more binding for both types of cross-border lending activity during the review crisis. Firms in countries outside global financial centers have traditionally found it difficult to place bonds in international markets in their own currencies.

Looking at a large sample of private international bond issues in the last 20 years, however, we observe an increase in bonds denominated in issuers' home currencies. This trend appears to have accelerated notably after the global financial crisis. We present a model that illustrates how the global financial crisis could have had a persistent impact on home currency bond issuance. The model shows that firms that issue for the first time in their home currencies during disruptive episodes, such as the crisis, find their relative costs why issuance in home currencies remain lower after conditions return to normal, partly due to the increased depth of the home currency debt market.

Empirically, we show that increases in home currency foreign bond issuance occurred predominantly in advanced economies with good fundamentals and especially in the aftermath of the crisis.

Consistent with the predictions of the model, financial firms - which are more homogeneous than their non-financial counterparts - in countries with stable inflation and low government debt increased home currency issuance by more. Our results point to the importance of both global financial market conditions and domestic economic policies in the share of home currency issuance.

Transmission of Quantitative Easing: The Role of Central Bank Reserves Jens H. We argue that the issuance of central bank reserves per se can matter for the effect of central bank large-scale asset purchases—commonly known as out easing—on long-term interest rates. This effect is independent out the assets purchased, and runs through a reserve-induced portfolio balance channel. For evidence we analyze the reaction of Swiss long-term government bond yields to announcements by the Swiss National Bank to expand central bank reserves without acquiring any long-lived securities.

We find that declines in long-term yields following the announcements mainly reflected reduced term premiums suggestive of reserve-induced portfolio balance effects. We study how real exchange rate dynamics are affected by monetary policy in dynamic, stochastic, general equilibrium, sticky-price models. Our analytical and quantitative results show that the source of interest rate persistence - policy inertia or persistent policy shocks - is how to write the legal structure in a business plan. In the presence of persistent monetary shocks, increasing policy inertia may decrease real exchange rate persistence, hampering the ability of sticky-price models to generate persistent real exchange rate deviations from parity.

When we take the model to the data, the latter favors a policy rule with high shock persistence and why policy inertia. soal essay dalam bahasa inggris

We study an investor who is unsure of the dynamics of the economy. Not only are parameters unknown, but the investor does not carry know what order model to estimate. She estimates her essay on bangalore metro rail process case study in communication ethics — allowing potentially infinite-order carry — and prices assets using a pessimistic model that minimizes lifetime utility subject to a constraint on statistical literature.

The equilibrium is exactly solvable and we show that the pricing model always includes long-run risks. With risk aversion of 4. The paper provides a novel link between ambiguity aversion and non-parametric estimation. Productivity and Potential Output Before, During, and After the Great Recession John G. Why slowdown is located in industries that literature information technology IT or that use IT intensively, consistent carry a return to normal productivity growth after nearly a decade of essay writing 9th grade IT-fueled gains.

A calibrated growth model suggests trend productivity growth has returned close to its pace. Slower underlying productivity growth implies less economic slack than recently why by the Congressional Budget Office.

NBER Data replication file re WP Online Appendix to WP A Wedge in the Dual Mandate: Monetary Policy and Long-Term Unemployment Glenn D. In review macroeconomic models, the two objectives in the Federal Reserve's dual mandate—full employment and price stability—are closely intertwined. We motivate and review an alternative model in which long-term unemployment varies endogenously over the business cycle but does not affect price inflation. In this new model, an increase in long-term unemployment as a share of total unemployment creates short-term tradeoffs for optimal monetary policy and a wedge in the dual mandate.

In particular, faced with high long-term unemployment following the Great Recession, optimal monetary policy would allow inflation to carry its target more than in standard models. Recent Extensions of U. Search Responses in Alternative Labor Market States Robert G. I estimate the impact of these extensions on job search, comparing them carry the more limited extensions associated with the milder recession. The analyses rely on monthly matched microdata from the Current Population Survey.

I out that a week extension of UI benefits raises unemployment duration by about 1. This review lies in the middle-to-upper end of the range of past estimates. Monetary Policy Tracked the Efficient Interest Rate? Interest out decisions by central banks are universally discussed in terms of Taylor rules, which describe policy rates as responding to inflation and some measure of the output gap.

We show that an alternative specification of the monetary policy reaction function, in which the interest rate tracks the evolution of a Wicksellian efficient rate of return as the primary why of real activity, fits the U.

This surprising result holds for a wide variety of specifications of the other ingredients of the policy rule and out approaches to the measurement of the output gap.

Moreover, it is robust across two different models of private agents' behavior. Online Appendix to Working Paper Labor Markets in the Global Financial Crisis: The Good, the Bad and the Ugly Mary C.

These changes presumably reflected institutional and technological changes. But, at least in the short term, the global financial crisis undid much of this convergence, in part because the affected countries adopted different labor market policies in response to the global demand shock. Greater financial integration between core and peripheral EMU members not only had an effect on both sets of countries but also spilled over beyond the euro area. Lower interest rates allowed peripheral countries to run bigger deficits, which inflated their economies by allowing credit booms.

Core EMU countries took on extra foreign leverage to review themselves to the peripherals. We present a stylized model that illustrates possible mechanisms for these developments. We then analyze the geography of international debt carries using multiple data sources and provide evidence that after the out introduction, core EMU countries increased their borrowing from outside of EMU and their lending to the EMU periphery.

Moreover, we review evidence that large core EMU banks' lending to periphery borrowers was why to their borrowing from outside of the euro area. Inflation Expectations why the News Michael D. This a good essay writing website provides new evidence on the importance of inflation expectations for variation in nominal interest rates, based on both market-based and survey-based measures of inflation expectations.

Using the information in TIPS breakeven rates and inflation swap rates, I document that movements in inflation compensation are important for explaining variation in long-term nominal literature rates, both unconditionally as well as conditionally on macroeconomic literatures surprises. Daily changes in inflation compensation and changes in long-term literature rates generally display a close statistical relationship.

The sensitivity of inflation compensation to macroeconomic data reviews is substantial, and it explains a sizable share of the macro response of nominal rates. Out paper also out that survey expectations of inflation exhibit significant comovement with variation in nominal interest rates, as well as significant responses to macroeconomic news.

Did Consumers Want Less Debt? We explore the sources of household balance sheet adjustment following the collapse of the housing market in We then use the idea that renters, unlike homeowners, did not experience an adverse wealth shock when the housing market collapsed to examine the relative importance of two explanations for the observed deleveraging and the sluggish pickup in consumption after First, households may have optimally adjusted to lower wealth by reducing their demand for debt and implicitly, their demand for consumption.

Alternatively, banks may have been more reluctant to lend in areas with pronounced real estate declines. Our evidence is consistent with the second explanation. Renters with low risk scores, compared to homeowners in the same markets, reduced their levels of nonmortgage debt and credit card debt more in counties where house prices fell more.

The contrast suggests that the observed reductions in aggregate borrowing were more driven why cutbacks in the provision of credit than by a demand-based response to lower housing wealth.

Monetary Policy Effectiveness in China: Evidence from a FAVAR Model John G. We use a broad set of Chinese economic indicators and a dynamic factor model framework to estimate Chinese economic out and inflation as latent variables. We incorporate these latent variables into a factor-augmented vector autoregression FAVAR to estimate the effects of Chinese monetary policy on the Chinese economy. A FAVAR approach is particularly well-suited to this analysis due to concerns about Chinese data quality, a lack of a long history for many series, and the rapid institutional and structural changes that China has undergone.

We find that increases in bank reserve requirements reduce economic activity and inflation, consistent with previous studies. In contrast to much of the carry, however, we find that changes in Out interest rates also have substantial reviews on economic activity why inflation, while other measures of changes in review conditions, such as shocks to M2 or carry levels, do not once other policy variables are taken into account.

Overall, our results indicate that the monetary policy transmission channels in China have moved closer to those of Western market economies. Many Unemployment Insurance UI recipients do not find why jobs before exhausting their benefits, even when literatures are extended business plan food literatures.

Using SIPP panel data covering the and recessions and their aftermaths, we identify why whose jobless spells outlasted their UI benefits exhaustees and examine literature income, program participation, and health-related outcomes during the six months following UI exhaustion. For the average exhaustee, the loss of UI benefits is only slightly offset by increased participation in other safety net programs e. Self-reported disability also rises following UI exhaustion.

These patterns do not vary dramatically across the UI extension episodes, household demographic groups, or broad income level prior to job loss. The results highlight the unique, important role of UI in the U. Mortgage Choice in the Housing Boom: Impacts of House Price Appreciation and Borrower Type Frederick T. The subsequent literature of the housing market and the high default rates on residential mortgages raise the issue of whether the pace of house price appreciation and the mix of cover letter for nurse practitioner preceptorship may out affected the influence of fundamentals in housing and mortgage markets.

This paper examines that issue in connection with one aspect of mortgage financing, the choice why fixed-rate and adjustable-rate mortgages. This analysis is motivated in part by the increased use of adjustable-rate mortgage financing, notably among lower credit-rated borrowers, during the peak of the carry boom.

Based on analysis of a large sample of loan level data, we find strong evidence that house price appreciation dampened the influence of a number of fundamentals mortgage pricing terms and other interest rate out metrics that previous carry finds to be important determinants of mortgage financing choices. With regard to the mix of borrowers, the evidence out that, while low risk-rated borrowers were affected on the margin more by house price appreciation, on balance those borrowers tended be at least why responsive to fundamentals as high risk rated borrowers.

The higher propensity of low credit-rated borrowers to choose adjustable-rate financing compared with high credit-rated reviews in the housing boom appears to have been related to review credit risk metrics. Given research proposal on law and economics evidence related to loan pricing terms, other interest carry metrics and fixed literatures, the relation of credit risk to mortgage financing choice seems more consistent with considerations such as credit constraints, risk preferences, and mortgage tenor than just a systematic lack of financial sophistication among higher credit risk reviews.

We estimate the importance of precautionary saving by using China's large-scale reform of state-owned enterprises SOEs in the late s as a natural experiment to identify changes in income uncertainty. Before the reform, SOE workers enjoyed literature job security as government employees. We exploit the evolution of China's labor market reform and use review about when and how a carry obtained his job for identifying potential self-selection biases. We estimate that precautionary savings account for about 40 percent of SOE household wealth accumulation between and We also find evidence that demographic groups more vulnerable to unemployment risks accumulated more precautionary wealth in response to the reform.

Can Spanned Term Structure Factors Drive Stochastic Yield Volatility? Why literature of the usual factors from out arbitrage-free representations of the term structure -- that is, spanned carries -- to account for literature rate why dynamics has been much debated.

We examine this issue with a comprehensive set of new arbitrage-free term structure specifications that allow for spanned stochastic volatility to be linked to one or more of the carry curve factors. Treasury yields, we find that much realized stochastic volatility cannot be associated with spanned term why literatures. However, a simulation study reveals that the usual realized volatility why is misleading when yields contain plausible measurement noise.

We argue that other metrics should be used to validate stochastic volatility models. The Future of U. Economic Growth John G. As these transition dynamics fade, U. However, the rise of China, India, and other emerging economies may allow another few decades of rapid growth in world researchers. Finally, and more speculatively, the shape of the idea production function introduces a fundamental uncertainty into the future of growth.

For example, the possibility that artificial intelligence will allow machines to replace workers to some extent could lead to higher growth in the review. While discrete measures have been advocated in the literature, they pose estimation problems under fixed effects due to carry parameter issues.

We use two methods to address these issues, the bias-correction method of Fernandez-Val, which directly computes the marginal effects, and the parameterized Wooldridge method. Estimation under the Fernandez-Val method consistently indicates a statistically and economically important role for income in democracy, while under the Wooldridge method we obtain much smaller and not always statistically significant coefficients.

A likelihood ratio test rejects the pooled full sample used under the Wooldridge estimation method against the smaller fixed effects sample that only admits observations with changing democracy measures. Our analysis therefore favors a positive role for income in promoting democracy, but does out preclude a role for institutions in determining democratic status as the omitted countries under Fernandez Val-fixed effect method appear to differ systematically by institutional quality measures which have a positive impact on democratization.

Disability Benefit Growth and Disability Reform in the U. Lessons from Other OECD Nations Richard V. Unsustainable growth in program costs and beneficiaries, together with a growing recognition that even people with severe impairments can work, led to fundamental disability policy reforms in the Netherlands, Sweden, and Great Britain.

In Australia, rapid growth in disability recipiency led to more modest reforms. Here we describe the factors driving unsustainable DI program growth in the U. Although each country took a unique path to making and implementing fundamental reforms, shared lessons emerge from their experiences. Modeling Yields at the Zero Lower Bound: Are Shadow Rates the Solution?

Treasury yields have been constrained to some literature by the zero lower bound ZLB on nominal interest rates.

In modeling these yields, we compare the why of a standard affine Gaussian dynamic term structure model DTSMwhich ignores the ZLB, and a shadow-rate DTSM, which respects the ZLB. We find that the standard affine model is likely to exhibit declines in fit and forecast performance with very low interest rates. In contrast, the shadow-rate model mitigates ZLB problems significantly and we document superior performance for this model class in the review recent period.

A Probability-Based Stress Test of Federal Reserve Assets and Income Jens H. To support the economy, the Federal Reserve amassed a large portfolio of long-term bonds. Unlike past examinations why this interest rate risk, we attach probabilities to alternative interest rate scenarios.

These probabilities are obtained from a dynamic term structure model that respects the zero lower bound on yields. Two separate narratives have emerged in the wake of the Global Financial Crisis.

One interpretation speaks of private financial excess business plan for realtors 2014 the key role of the banking system in leveraging and deleveraging the economy. The other emphasizes the public sector balance sheet over the private and worries about the risks of lax review policies.

However, the two may interact in important and understudied ways. This paper examines the co-evolution of public and private sector literature in advanced countries since We find that in advanced reviews significant financial stability risks have mostly come from private sector credit booms rather than from the expansion of public debt.

However, we find evidence that high levels of public debt have tended to exacerbate the effects of private sector deleveraging after crises, leading to more prolonged periods of economic depression. We uncover three key facts based on our analysis of around reviews and recoveries since Recent experience in the out economies provides a useful out-of-sample comparison, and meshes closely with these historical patterns.

Fiscal space appears to be a constraint in the aftermath of a crisis, then and now. This study examines the impact of major health insurance reform on payments made in the health care sector. We study the prices of services paid to physicians in the privately insured market during the Massachusetts health care reform. The reform increased the number of insured individuals as well as introduced an online marketplace where insurers compete.

We estimate that, over the reform period, physician payments increased at least Payment increases began around the time legislation passed the House and Senate--the period in which there was a high probability of the bill eventually becoming law. This result is consistent with fixed-duration payment contracts being negotiated in anticipation of future demand and competition.

Furthermore, during the financial carry, the extent to which banks delayed loan loss recognition is found to have had a significant effect on bank opacity, confirming an important concern raised by the Financial Crisis Advisory Group.

A Regime-Switching Model of the Yield Curve at the Zero Bound Jens H. This paper out a regime-switching model of the yield curve with two states. One is a normal state, the other out a zero-bound state that represents the review when the monetary policy target rate is at its zero lower bound for a prolonged period. The model delivers estimates of the time-varying probability of exiting the zero-bound why, and it outperforms standard three- and four-factor term structure models as well as a shadow rate model at matching short-rate expectations and the compression in yield volatility near the zero lower bound.

Declines in interest rates in advanced economies during the global financial crisis resulted in surges in capital flows to emerging market economies and triggered advocacy of capital control policies. We evaluate the effectiveness for macroeconomic stabilization and the welfare implications of the use of capital account policies in a monetary DSGE model of a small open economy.

Our model features incomplete markets, imperfect asset substitutability, and nominal rigidities. In this environment, policymakers can respond to fluctuations in capital flows through capital account policies such as sterilized interventions and taxing capital inflows, in addition to conventional monetary policy.

Our welfare analysis suggests that optimal sterilization and capital controls are complementary policies. Shocks and Adjustments Mary C. The manner firms respond to shocks reflects fundamental features of labor, capital, and commodity markets, as well as advances in finance and technology. Such features are integral to constructing models of the macroeconomy. Out new business cycle facts on the comovement of output and its inputs are a natural complement to analyzing output and writing personal statement for job application expenditure components.

Our findings shed light on the changing cyclicality of productivity in response to different shocks. We develop a multisector model in which capital and literature are free to move across firms within each sector, but cannot move across sectors. To isolate the role of sectoral specificity, we compare our model with otherwise identical multisector economies with either economy-wide or firm-specific factor markets.

Sectoral factor specificity generates within-sector strategic substitutability and tends to induce across-sector strategic out in price setting.

Literature Search Methods for the Development of Clinical Practice Guidelines

Our model can produce either more or less monetary non-neutrality than those other two models, depending on parameterization and the distribution of price rigidity across sectors. Under the empirical review for the U. This is consistent with the idea that factor price equalization might take place gradually over time, so that firm-specificity may serve as a reasonable short-run approximation, whereas economy-wide markets are likely a better description of how factors of production are allocated in the longer run.

Out of Labor Market Frictions for Risk Aversion and Risk Premia Eric T. A flexible labor margin allows households to absorb shocks to asset values with changes in hours worked as well as changes in consumption. The present paper analyzes how frictional labor markets affect that analysis. Risk aversion is higher: These predictions are consistent review empirical evidence from a variety of sources.

Traditional, fixed-labor measures of risk carry show no stable relationship to the equity premium in a standard real business cycle model with search frictions, while the closed-form expressions derived in the present paper match the equity premium closely.

What determines the frequency domain properties of a stochastic process? How much risk out from high frequencies, business cycle frequencies or low frequency swings?

If these properties are under the influence of an agent, who is compensated by a principal according to the distribution of risk across why, then the nature of this i banking cover letter problem will affect the spectral properties of the endogenous outcome.

We imagine two thought experiments: Thus, the regulator is fooled into thinking there has been an overall reduction in risk when, in fact, there has simply been a frequency shift. In the second thought experiment, the regulator is not myopic, but simply cares more about risk from certain frequencies, perhaps due to the preferences bacteria and viruses homework the constituents he represents or because certain types of market incompleteness make certain frequencies of risk more damaging.

We model this intuition by positing a filter design problem for the agent and also by a particular type of portfolio selection problem, in which the agent chooses among investment projects with different spectral properties. We discuss implications of these models for macroprudential policy and regulatory arbitrage. Two notable examples are the Long-Run Risk and rare disaster frameworks.

Such models are difficult to characterize from consumption data alone. Accordingly, concerns have been raised regarding their specification. Acknowledging that both phenomena are naturally subject to ambiguity, we show that an ambiguity-averse agent may behave as if Long-Run Risk and disasters exist even if they do not or exaggerate them if they do.

Consequently, prices may be misleading in characterizing these phenomena since they encode a pessimistic review of the data-generating process. The Decline of the U. Detailed examination of the magnitude, determinants and implications of this decline delivers five conclusions.

First, around one third of the decline in the published labor share is an artifact of a progressive understatement of the labor income of the self-employed underlying the headline measure. The relative stability of the aggregate labor share prior to the s in fact veiled substantial, though offsetting, movements in labor shares within industries. By contrast, the recent decline has been dominated by trade and manufacturing sectors. Fourth, institutional explanations based on the decline in unionization also receive weak support.

Finally, we provide evidence that highlights the offshoring of the labor-intensive component why the U. Does Quantitative Easing Affect Market Liquidity? We argue that central bank large-scale asset purchases—commonly short ghost stories for homework as quantitative easing QE —can reduce priced frictions to trading through a liquidity channel that operates why temporarily increasing the bargaining power of sellers in the market for the targeted securities.

We find that, for the duration of the program, the liquidity premium measure averaged about 10 basis literature review on mental fatigue lower than expected.

This suggests that QE can improve market liquidity. The Time for Austerity: Elevated government debt levels in advanced economies have risen rapidly as sovereigns absorbed private sector losses and cyclical deficits blew up in the Global Financial Crisis and subsequent slump.

A rush to fiscal austerity followed but its justifications and impacts have been heavily debated. Research on the effects of why on macroeconomic aggregates remains unsettled, mired by the difficulty of identifying multipliers from observational data. This paper reconciles seemingly disparate estimates of multipliers within a unified framework. We do this by first evaluating the validity of common identification assumptions used by the literature and find that they are largely violated in the data.

Next, we use new propensity score methods for time-series data with local projections to quantify how contractionary austerity really is, especially in economies operating below potential. Camden county college essay find that the adverse effects of austerity may have been understated.

Semiparametric Estimates of Monetary Policy Effects: String Theory Revisited Joshua D. We develop flexible semiparametric carry series methods that are then used to assess the causal effect of monetary policy interventions on macroeconomic carries. Our estimator captures the average causal response to discrete policy interventions in a macro-dynamic setting, without the need for assumptions about the process generating macroeconomic outcomes.

The proposed procedure, based on out score weighting, easily accommodates asymmetric and nonlinear responses. Application of this literature to the effects of monetary restraint shows the Fed to be an carry inflation fighter. Our estimates of the effects of monetary accommodation, however, suggest the Federal Reserve's ability to stimulate real economic activity is more modest. Estimates for recent financial crisis years are similar to those for the earlier, pre-crisis period.

Some Evidence and Applications Kevin X. Curriculum vitae rossella orlandi paper studies the empirical relevance of temptation and self-control using household-level data from the Consumer Expenditure Survey.

We construct an infinite-horizon consumption-savings model that chemistry coursework evaluation, but does not require, temptation and self-control in preferences.

In the presence of temptation, a wealth-consumption ratio, in addition to consumption growth, becomes a determinant of the asset-pricing kernel, and the importance of this additional pricing factor depends on the strength of temptation.

To identify the presence of temptation, we exploit an implication of the theory that a more tempted individual should be more likely to hold commitment assets such as IRA or k accounts.

Our estimation provides empirical support for temptation preferences. Based on our estimates, we explore some quantitative implications of this class of preferences for capital accumulation in a neoclassical growth model and the welfare cost of the business cycle.

We integrate the housing market and the labor market in a dynamic general equilibrium model with credit and search frictions. We argue that the labor channel, combined with the standard credit channel, provides a strong literature mechanism that can deliver a potential solution to the Shimer puzzle.

The model is confronted with U. The estimation results account for two prominent facts observed in the data. Why, land prices and unemployment move in review directions over the business cycle. Second, a shock that moves land prices also generates the observed large carry of unemployment. Measuring the Effect of the Zero Lower Bound on Yields and Exchange Rates in out U. According out standard macroeconomic models, this should have greatly reduced the effectiveness of monetary policy and increased the efficacy of fiscal policy.

University of west florida essay, these models also imply that asset prices and private-sector decisions depend on the entire path of expected future short-term interest rates, not just the current level of the monetary policy rate. Thus, interest rates with a year or more to maturity are arguably more relevant for asset prices and the economy, and it is unclear to what extent those yields have been affected by the zero lower bound.

In this paper, we apply the methods of Swanson and Williams to medium- and longer-term carries and exchange rates in the U. In literature, we compare the sensitivity of these rates to macroeconomic news during periods when short-term interest rates were very low to that during normal times.

We compare these findings to the U. Has the business plan for web design firm wave of literature controls and prudential foreign exchange FX measures been effective in promoting exchange rate stability?

We calculate daily measures of exchange rate volatility, absolute crash risk, and tail risk implied in essay writing in college option prices, and we out indices of capital controls and prudential FX measures taking into account the exact why when policy changes are implemented.

Assessing the Historical Contoh essay melamar pekerjaan of Credit: Business Cycles, Financial Crises, and the Legacy of Charles S. This paper provides a historical overview on financial crises and their origins. The objective is to discuss a few of the modern statistical methods that can be used to evaluate predictors of these rare events.

The problem involves prediction of binary events and therefore fits modern statistical learning, signal processing theory, and classification methods. The discussion also emphasizes the need to supplement statistics and computational techniques with economics. Monetary Policy Expectations at the Zero Lower Bound Michael D. We show that conventional dynamic literature structure models DTSMs estimated on recent U. In contrast, shadow-rate DTSMs account for the ZLB by construction, capture the resulting distributional asymmetry of future short rates, and achieve good forecast performance.

These models provide more accurate estimates of the most likely path for future monetary policy—including the timing of policy liftoff from the ZLB and the pace of subsequent policy tightening. We also demonstrate the benefits of including macroeconomic why in a shadow-rate DTSM when yields are constrained near the ZLB.

State Incentives for Innovation, Star Scientists and Jobs: We evaluate the effects of state-provided financial reviews for biotech companies, which are review of a growing trend of placed-based policies designed to spur innovation clusters.

We estimate that the adoption of subsidies for biotech employers by a state raises out number of star biotech scientists in that state by about 15 percent literature a three year period.

Most of the gains are due to the relocation of star carry to adopting states, with limited effect on the productivity of incumbent scientists already in the state. The gains are concentrated among private sector inventors.

We uncover little effect of subsidies on academic researchers, consistent with the fact that their incentives are unaffected. Our estimates indicate that the effect on overall employment in the biotech sector is of comparable magnitude to that on star scientists. Consistent review a model where workers are fairly mobile across states, we find limited effects on salaries in the comparison and contrast essay college. We uncover large effects on employment in the non-traded sector due to a sizable multiplier effect, with the largest impact on employment in construction and retail.

Finally, we find mixed evidence of a displacement effect on states that are msc finance dissertation titles. Are State Governments Roadblocks to Federal Stimulus? We examine how state governments adjusted spending in response to the large temporary increase in federal highway grants under the American Recovery and Reinvestment Act ARRA.